Financial Strategies for Young Families

As Scottish poet Robert Burns famously observed, “the best-laid plans of mice and men often go astray.” We’ve all experienced times when our plans and intentions got sidelined by unanticipated events. Especially in the early years of starting a family, when children come along, careers are getting underway, and life starts to really pick up […]

10 Things to Do before You Retire

Stick to your savings plan. The number-one building block for a secure retirement is building up your retirement nest egg as much as possible. Unfortunately, this is also the number-one shortcoming of most Americans. While more than half of Americans report having a retirement savings plan, less than half believe they’ll have enough saved to […]

Covering the Bases with Medicare

Whether you are registered for Medicare, you’re not registered but eligible (age 65 or older), or you’re already receiving Medicare benefits but you’re thinking about changing your plan, you need to know that the current enrollment period for Medicare coverage in 2026 runs from October 15, 2025, to December 7, 2025. During this period, you […]

Spousal Benefits and Social Security

In 2024, more than three million Americans filed for Social Security benefits. Further, in the first half of fiscal 2025 alone, the claim system, which includes online, telephone, hard-copy, and in-person applications, a record number of individuals applied for retirement benefits from the Social Security Administration. Without a doubt, Social Security benefits are a central […]

Finance 101: Student Loan Tips for Recent Graduates

You did it! You walked across the stage and received your diploma, perhaps along with a handshake from the dean or maybe even your college president. You got that degree, and now that you’ve started your first “real” job, you’re on the way into your professional future. But along with the satisfaction of beginning your […]

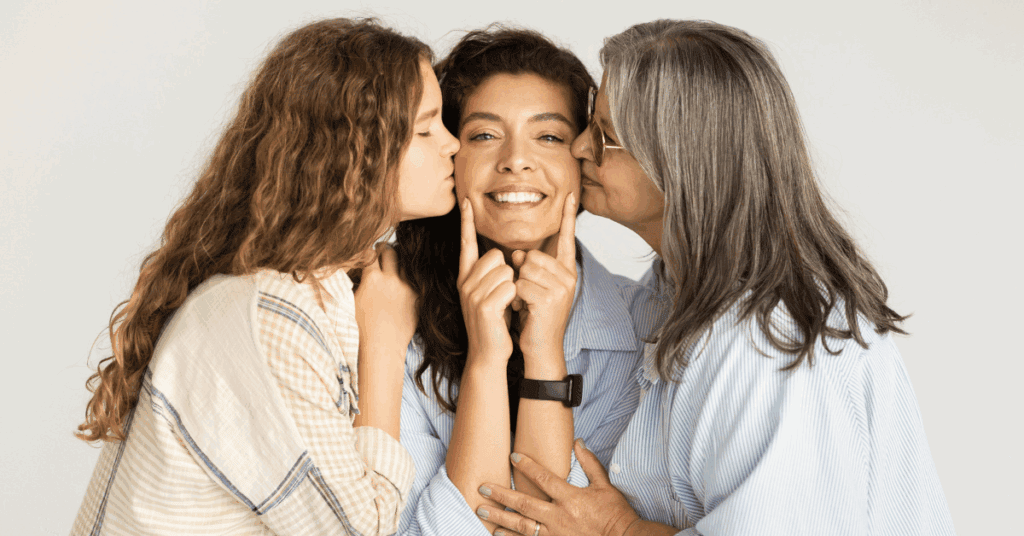

Feeling the Squeeze: The Challenges of the “Sandwich Generation”

In 2005, an AARP report noted the fact that 25% of Generation X-ers (ages 29–39 at that time) were still receiving financial support from their parents or other family members. Would you care to guess how that trend has changed from then to now? According to a 2024 report from the Pew Research Center, 44% […]

Insurance and Your Financial Plan: An Essential Element

When was the last time you financed a new vehicle? You probably remember that the lienholder—whether it was a bank, a credit union, or the dealership’s financing company—made sure you had insurance coverage on the new vehicle. Why? Because they weren’t willing to run the risk of something happening to their valuable collateral (your new […]

Is “Aging in Place” the Right Choice for Your Retirement?

For many of our grandparents, the whole concept of “retirement” as we now think of it would be pretty foreign. After all, the average life expectancy was much lower in times past than it is today, when many of us can expect to live well into our 80s, 90s, or even longer. According to some […]

What Is a Certified Financial Planner® Professional?

When seeking advice or help in many important areas of life, we instinctively understand the value of making sure that the person providing us with assistance is thoroughly qualified and has the necessary expertise. Obviously, no one would seriously consider making an important medical decision without consulting someone who had the right credentials—either an MD […]

Too Much Money in a 529 Plan? Here Are Some Ideas

Can there really be such a thing as having too much money in an account? Most of the time, this would be hard to imagine, but when a 529 education funding plan has excess funds and no qualified educational expenses left to pay, it can create a bit of a quandary. Because withdrawals from a […]