Your Social Security Checklist

For most Americans preparing for retirement, Social Security is an important component of the overall retirement income strategy. There are two basic benefits available: retirement and disability. You are generally eligible to file for Social Security retirement benefits if you are 62 or older and you have worked for an employer who has paid into […]

Time for Your 2024 Year-End Checkup

As another year slides toward its close, it’s probably a good time for most investors to do a few year-end “tuneups” on portfolios, financial and estate plans, and charitable or philanthropic strategies. In this article, we’ll mention a few items that almost always benefit from some attention, especially at year-end. Watch your fund distributions. For […]

Who Do You Trust? Questions to Ask when Choosing a Financial Advisor

There’s a famous scene in the movie, Indiana Jones and the Last Crusade; you probably remember it. Jones, the adventurous archaeologist, must pass three tests to gain access to the cave that houses the Holy Grail. His last test, the hardest, is to take a step of faith. He can see the opening to the […]

The ABCs of DAFs: Donor-Advised Funds and Your Charitable Giving

If you’re like many taxpayers, you’ve been taking a fresh look at the role your itemized personal deductions play on your tax return. Since the Tax Cuts and Jobs Act (TCJA) of 2017 significantly raised the standard deduction ($14,600 in 2024; $29,200 for those married filing jointly), many taxpayers who used to get a healthy […]

Financial Independence vs. Making Money: What’s the Difference?

Over the last few years, a lot of attention has been focused on the FIRE movement: “Financially Independent, Retire Early.” The basic premise of those who are pursuing this way of life is that, by means of “extreme” frugality, saving, and investing, it is possible to retire much earlier than the traditional age and live […]

Year-End Gifting for 2024: Some Important Considerations

As this is written, football season is getting underway and for much of the country, summer heat is starting to give way to more pleasant temperatures. We’re wrapping up the third quarter of 2024 and about to enter the busy fall and winter holiday season. As we look toward the winding down of 2024, it’s […]

Having “the Talk”: Communicating with the Kids about Your Estate Plan

Not too long ago, we shared many of the following thoughts with clients in a newsletter. But the topic of responsibly handling and communicating your estate plan is one that never goes out of style, and we thought it would be helpful to underline many of these important ideas here, on our blog. The fact […]

“My Deceased Husband Owned a Business: What Do I Do?”

Grieving the loss of a spouse is perhaps the most difficult crucible anyone can endure. The fog of grief can make it seem impossible to take even the simplest action; it’s as if the whole world has been turned upside down. For someone whose spouse was a business owner, however, it can be even harder. […]

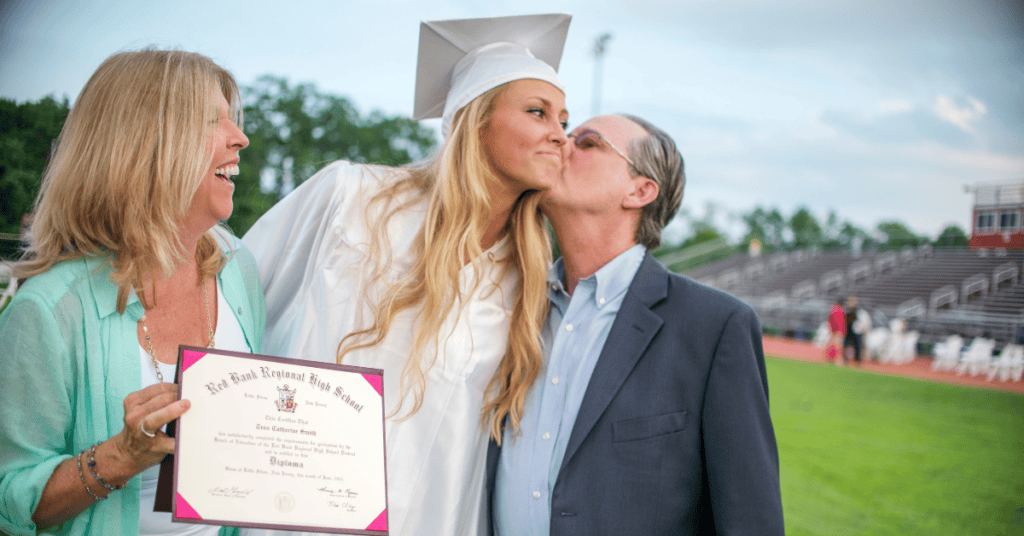

The FAFSA Is New for 2024–25: A Summary of the Changes

If you’ve ever had a child who applied for college or even technical training, you’ve probably dealt with the FAFSA—the Free Application for Federal Student Aid. Parents with students within a year or two of college enrollment must fill out the application and provide the required family financial data so that they can be considered […]

529 Plans and SECURE 2.0: Now Even Better

In 1996, Congress authorized 529 education savings plans, named for the section of the Internal Revenue Code governing them. Since that time, parents and grandparents have been using 529 education savings plans to help fund college for children and grandchildren. By depositing funds in these state-sponsored accounts, owners can provide funding that grows on a […]