Insurance and Your Financial Plan: An Essential Element

When was the last time you financed a new vehicle? You probably remember that the lienholder—whether it was a bank, a credit union, or the dealership’s financing company—made sure you had insurance coverage on the new vehicle. Why? Because they weren’t willing to run the risk of something happening to their valuable collateral (your new […]

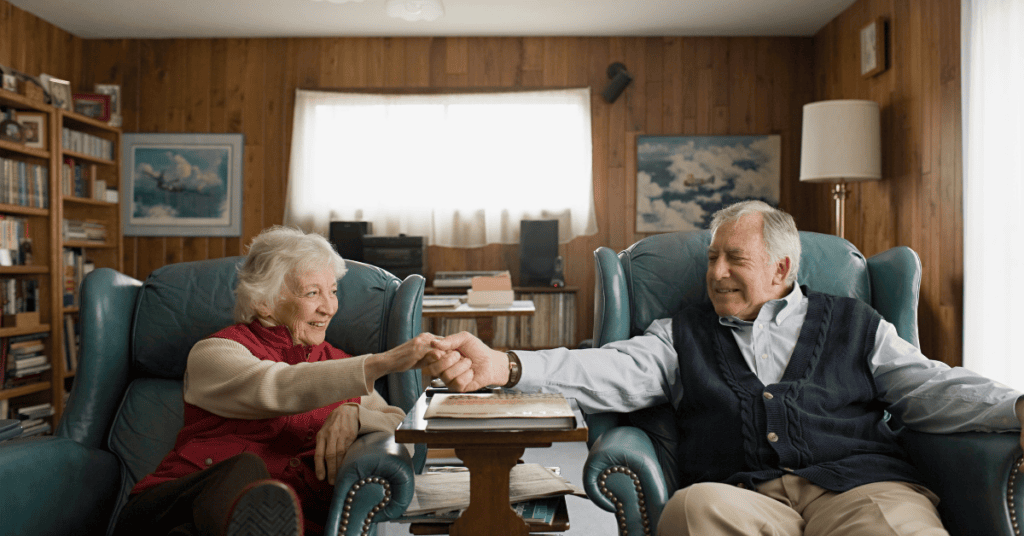

Is “Aging in Place” the Right Choice for Your Retirement?

For many of our grandparents, the whole concept of “retirement” as we now think of it would be pretty foreign. After all, the average life expectancy was much lower in times past than it is today, when many of us can expect to live well into our 80s, 90s, or even longer. According to some […]

What Is a Certified Financial Planner® Professional?

When seeking advice or help in many important areas of life, we instinctively understand the value of making sure that the person providing us with assistance is thoroughly qualified and has the necessary expertise. Obviously, no one would seriously consider making an important medical decision without consulting someone who had the right credentials—either an MD […]

Too Much Money in a 529 Plan? Here Are Some Ideas

Can there really be such a thing as having too much money in an account? Most of the time, this would be hard to imagine, but when a 529 education funding plan has excess funds and no qualified educational expenses left to pay, it can create a bit of a quandary. Because withdrawals from a […]

Getting Through the Fog: Surviving the Early Days of Widowhood

I was only three years old when my father died, so my memory of losing him so unexpectedly is clouded at best, Still, I am certain that any shock and bewilderment I had were miniscule compared to what my mother experienced, especially in those confusing and overwhelming first days. There is probably nothing most of […]

After “I Do”: Estate Planning for Newlyweds

Getting married is one of life’s watershed events; few other things usher in as many changes, adjustments—and joys—as starting a new home with the person you love most in the world. The days and weeks after the wedding are typically filled with dozens of decisions and changes: moving into a new home, combining your “stuff,” […]

“This Changes Everything”: How an Inheritance Affects Your Financial Plan

Several years ago, a friend of ours was in the audience as novelist John Grisham related the story of how he “made it.” According to Grisham, he had recently turned in the manuscript for what would become his breakout bestseller The Firm. It was a Sunday morning, and he was preparing to teach the kindergarten […]

Diversification: Your Best Tool for Managing Portfolio Risk

There’s an old story that goes like this: two farmers are sitting in the feed store, talking over the prospects for the coming season. One says to the other, “How’s your cotton crop looking?” The other replies, “I didn’t plant cotton; I’m too worried about the boll weevils.” “Well,” the other says, “then I guess […]

Retirement Newbie: Creating a Smooth Transition for your First Year

Retirement is a goal many Americans are eagerly looking forward to achieving, and why not? After all, you’ve worked and planned for the time when you will be able to spend your time more on your terms, occupying yourself with the people and activities that are most important to you. You should look forward to […]

Estate Planning and Trusts: How to Know When a Will Isn’t Enough

Having a valid will in place is Estate Planning 101. After all, if you don’t have a plan for how your assets will be distributed after your passing, your state has a one-size-fits-all solution. So, having a basic plan in place that takes into consideration the particulars of your family, your assets, and other specifics […]