Inflation has been in the headlines quite a bit lately, so today, we’re going to address what all the hoopla is about. We had an extraordinary year in 2020. There were unprecedented spending and policy programs that will be written into history. But with every action, there is a reaction, and so it should come as no surprise that inflation is one of those potentially concerning reactions.

We all know that the media loves to emphasize the next impending doom. In April of 2021 the Consumer Price Index (CPI) reported a 4.2% year-over-year increase, which is the highest rate in over a decade. We’ve been hearing about rising lumber costs, gas prices soaring, and grocery prices rising, which, broadly speaking, are all indications of inflation. The CPI unfortunately also has its limitations – for instance, it only measures spending in metro markets, and doesn’t measure price fluctuations caused by environmental or social trends. However, it is still our yardstick for inflation, deflation, and cost of living adjustments. The real question we have, though, is whether the US economy has entered an entirely new regime with structurally higher long-term inflation ahead.

When taking a deeper look at inflation, here are some key factors to consider, as compiled by Manning & Napier.

- Transitory vs. Structural Inflation: First off, it’s absolutely necessary to distinguish between transitory and persistent inflation. When you consider interest rate policy and that it should be the growth in wage incomes that drives the assessment of persistent inflationary undercurrents, the shift in spending areas is liable to create some one-off inflation, especially as availability comes back online. If this inflation does not show up in wage incomes, there are minimal reasons for the Fed to respond.

- Demographics: The dependent population (both in youth and seniors) is associated with higher inflation, and the working age population with lower inflation. As boomers age out of the working population and longevity in life increases, this could be an added factor in the calculations for inflation.

- Globalization & Technology: Think diversification. The global integration through trade and supply chains can be impacted due to something like a global pandemic. However, with trade agreements being negotiated more regularly, and technology impacting business practices, we’re more likely to see globalization and technology as more of a blip than a long-term factor.

- Labor Bargaining Power: The biggest expense for most businesses is the cost of labor, however, technology and other automated methods have caused a decline in these costs over the past several decades. The swiftness of this change has caused productivity to increase far more quickly than wages, which actually should cause a decrease in consumer costs.

- Oil and Other Commodities: Domestic deflation is usually caused by commodity prices increasing because of a strong dollar. Therefore, a strong dollar typically means a decrease in commodity pricing. Because global trade prices are typically maintained in the U.S. market, import prices of consumer discretionary goods don’t always align with changes to the U.S. dollar. The bottom line is that commodity prices are not 100% indicative of inflation.

- Policy Wildcards: A major risk to inflation sits squarely with policymakers, both fiscal and monetary, with fiscal policy being the most impactful. As we begin to return to normal life, the real mystery is whether policymakers will continue to pump stimulus into the already healthy economy.

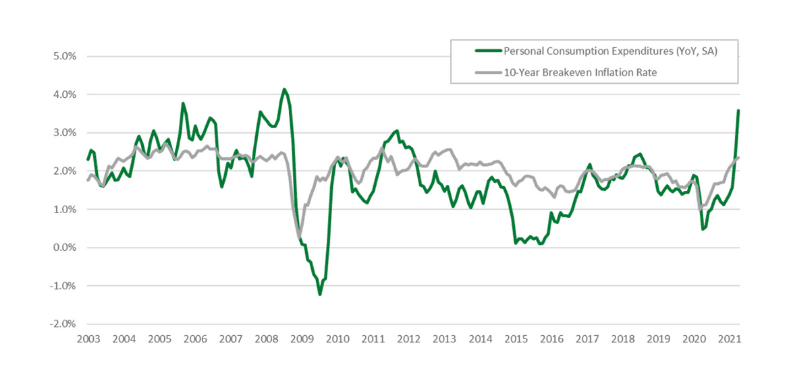

The chart below, notes post-pandemic uptick in the Federal Reserve’s preferred inflation indicator, PCE, as well as in the market’s inflation expectations, to a lesser extent.

In simple terms, the Federal Reserve’s preferred measure of inflation has averaged approximately 1.5%—2% annually over the past decade, whereas current market expectations are for prices to increase around 2.5%—3% over the next decade. Additionally, prices are increasing slightly more over the front 5 years than the back 5 years. This means that there will likely be higher near-term inflation than there will be long-term inflation. Essentially, this shows that the market believes the Fed will be successful in its efforts to have inflation average back to 2% over time.

Inflation concerns are likely to dominate the media in the near future as we continue to guess on the timing and scope of policy changes. It will no doubt be a bumpy ride as success by the Fed and other policymakers will likely cause an increase in market volatility. We’re watching these indicators closely but, as always, we understand that every person is unique and many factors dictate what your individual plan should be over time. We’re happy to hold the reigns and guide you along your financial path.

Read more from Manning & Napier.*

*This page contains links to third-party company websites. By selecting a link, you will be launching a new browser window. These links are provided for informational purposes only and should not be viewed as an endorsement, sponsorship, solicitation or other affiliation with respect to any third parties. We are not making any recommendations or providing any advice on securities in particular or investments in general. Neither Mathis Wealth Management nor United Planners Financial Services have reviewed the content of, and are not responsible for, the information or the results of the third-party websites.