In early May, headlines in the US financial media were dominated by the announcement that the US Federal Reserve Bank had raised the target federal funds rate (the interest rate charged by depository institutions to lend balances at the US Federal Reserve to make overnight loans to other depository institutions—often called “the Fed funds rate”) by 50 basis points, or ½ of 1 percent. This was significant because this was the largest single rate hike executed by the Fed since 2000. The US central bank took this action, along with the decision to begin selling Treasury bonds in its portfolio, in an attempt to rein in inflation, which has been plaguing the economy since late last year. By raising rates and reducing the money supply—“tightening” monetary policy, in financial market shorthand—the Fed hopes to coax inflation back to its desired target range of about 2% annually from its current annual rate of around 8.3%. Indications are that the Fed may employ additional 0.5% hikes during 2022.

This past week, at its June meeting, the Fed took another major action on interest rates. Responding to the latest readings on inflation—which showed an annual increase rate of 8.6%, higher than analysts were expecting—the Fed raised key interest rates by 0.75%, the largest single jump in nearly 30 years.

Uncontrolled inflation is certainly disastrous for any economy, and keeping a lid on it is one of the Fed’s main tasks. But what about rising interest rates, which generally accompany rate hikes like those currently being employed? Generally speaking, higher interest rates are seen as negative for stocks, because they mean higher operating expenses and correspondingly lower profit margins for companies. For this reason, some investors may worry that rising interest rates will decrease equity valuations and therefore lead to relatively poor equity market performance. As if to confirm this, the Dow dropped from 34,061.06 on the day of the Fed rate hike announcement in May, to 32,997.97 the day after (a drop of 3%), and the S&P 500 responded similarly, going from 4,300.17 on May 4 to 4,146.87 on May 5 (down 3.5%). On the day after the June announcement, the stock market seemed to take temporary comfort from the Fed’s tough stance on inflation, with the Dow rising over 300 points and the S&P 500 up by almost 60 points. But the next day, as investors and analysts appeared to perceive a higher likelihood of a recession, the Dow tumbled more than 700 points and the S&P 500 fell by 120 points. Currently, the Dow and the S&P 500 are down from their year-beginning readings; 18% and 23%, respectively.

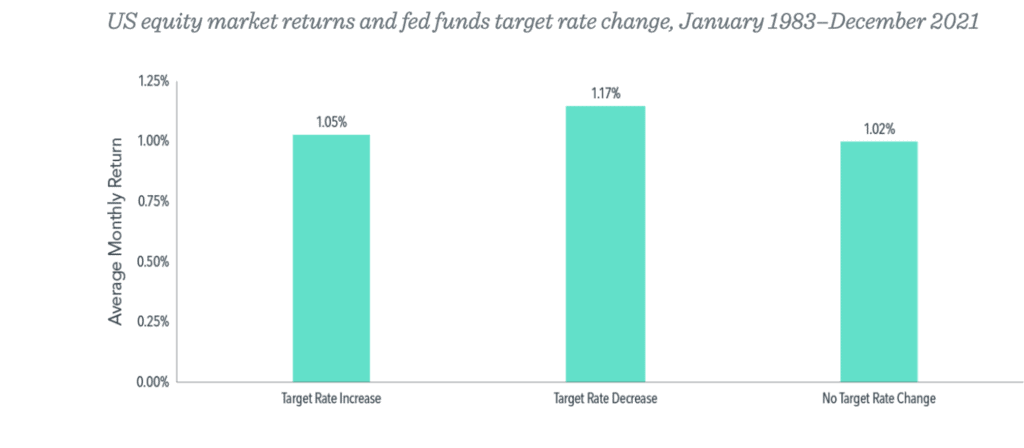

But what does history tell us about the relationship between Fed rate hikes and stock market performance? Analysts at Dimensional Fund Investors took a look at stock price performance as measured by a broad market index from 1983 to 2021, focusing on its response to changes in the Fed funds rate, whether the rate was raised, lowered, or remained the same. Over this period of 468 months, rates increased in 70 months and decreased in 67 months.

SOURCE: Dimensional Fund Advisors. Past performance is no guarantee of future results.

As indicated, in the 70 months when the Fed raised rates, the broad stock market delivered an average positive return for the month of 1.05%. In the 67 months when the Fed lowered rates, stock returns averaged 1.17% for the month. And in months when there was no change, returns averaged 1.02% for the month.

Of course, this begs the question: What about the months following rate hikes? That’s a valid point to consider, since Fed officials have indicated that multiple rate hikes of 0.50% or even 0.75% each may be needed to put the brakes on inflation. Can equity investments continue to turn in a positive performance in the face of consecutive increases in interest rates?

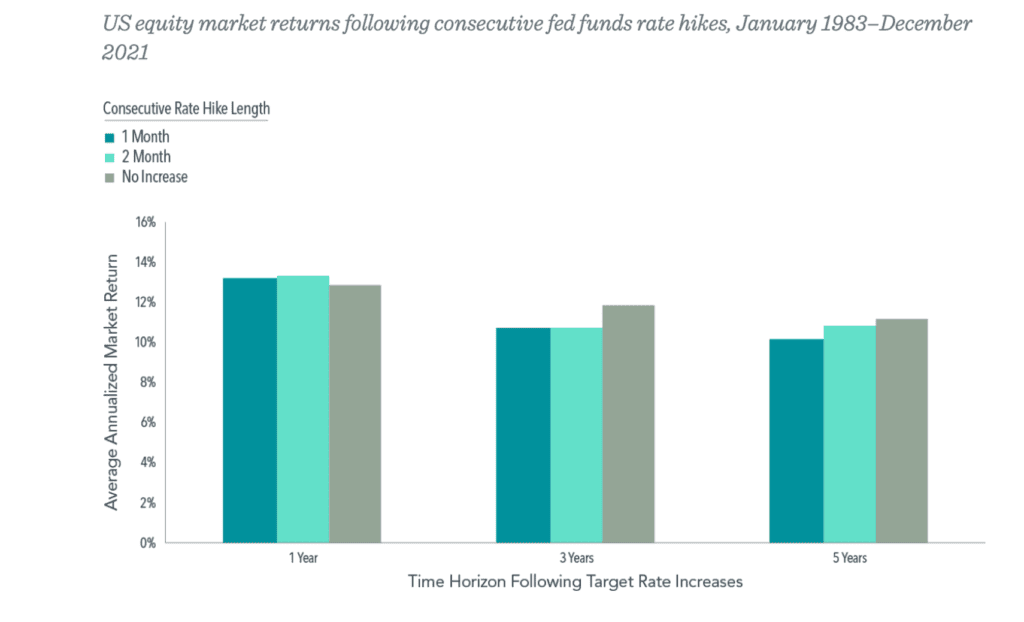

To look for an answer to this question, Dimensional Fund analysts looked at annualized US equity market returns over the one-, three-, and five-year periods following one or two consecutive monthly increases in the Fed funds target rate, as well as following months with no increase.

SOURCE: Dimensional Fund Advisors. Past performance is no guarantee of future results.

What they found was that returns on equities were very similar in the one-, three-, and five-year periods, both for instances involving consecutive rate hikes and those involving no rate hikes. Over time, the stock market has delivered dependably positive annual returns (in the range of 10–13%), irrespective of Fed action on interest rates.

Certainly, investors and analysts will be closely watching and listening for indications of future directions by the Federal Reserve. No doubt, market participants’ sentiments about the likely direction of future stock prices are being “baked in” to market pricing with each day’s trading, and markets are likely to continue fluctuating—probably with a downside bias—until worries about inflation and the economy are soothed by more encouraging trends. Nevertheless, while it’s natural to wonder what the Fed’s actions on interest rates mean for equity performance, research and history seem to indicate that US equity markets may, on average and over time, offer positive returns following rate hikes.

For investors, this means that reducing allocations of equities in the portfolio in response to worries about Fed actions on interest rates is not likely to contribute to superior investment outcomes. Instead, maintaining a well-diversified portfolio that matches the investor’s long-term goals and risk profile, periodically rebalancing in response to market action in order to stay within established allocation guidelines, and above all, remaining patient and disciplined are likely the keys to long-term success in most cases.

At Mathis Wealth Management, our goal is to offer the guidance, research, advice, and recommendations that our clients need in order to successfully navigate the ever-shifting financial landscape. Our fiduciary responsibility requires us to always keep the client’s best interest foremost in everything we do. If you have questions about your investments for retirement, higher education, or other important financial goals, we can provide answers. Or, if you’re wondering about current economic and market conditions and their effect on your financial strategy, we can help you get the information you need to make the decision that is right for you.

For additional resources, read our new whitepaper, Thriving as a Single-Income Family.

Note: This is meant for educational purposes only and information presented should not be considered investment advice. Past performance is no guarantee of future results.